Wealth inequality for women in Philadelphia has grown through systems of wealth extraction such as structural racism, racialized patriarchy, and racialized capitalism. These systems have resulted in the top 1% of the population holding 47% of the nation’s wealth and their wealth continues to grow exponentially by extracting from the rest of us.

This extractive economy which is deeply harming millions of human beings across the globe, is upheld and normalized by narratives that stigmatize and blame individuals for their current financial position. Scroll down to learn more about these myths and what you can do to challenge them.

Structural racism is a legacy of legalized white supremacy. Laws and systems put in place with the intention of keeping power in the hands of white people have led to generations of disenfranchised people of color in this country.

Patriarchy places power in the hands of men and disempowers women. Racialized patriarchy separates people into a hierarchy using both gender and race, having the most consequential impact on women of color.

This idea states racialized exploitation and capital accumulation are mutually compounding, placing women of color in the most difficult position in our capitalist economy.

No Data Found

No Data Found

Of Philadelphia women surveyed, on average, over half said that they are the primary caregiver for at least one child or minor. When asked about the financial impact of primary caregiving, only 1 in 3 Philadelphia women feel they have the financial support they need to support their caregiving responsibilities.9

While more women than ever receive education at the highest levels, this doesn’t directly lead to higher economic success. In Philadelphia, ~50% of Hispanic and Black women surveyed have student loan debt, compared to 39% of White women.9

No Data Found

With more debt and increasing costs comes limited resources for wealth building such as investing.

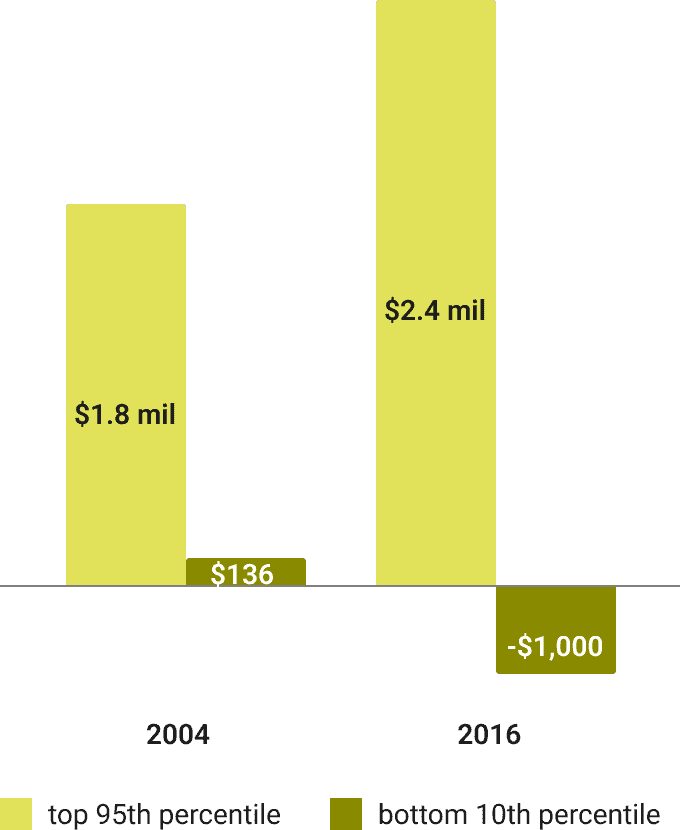

The odds are stacked against women when seeking financial stability. The wage gap isn’t the whole picture. The wealth gap should also be considered.

Access to healthcare is not always by need, but rather by wealth. Similar to the idea of food deserts, there are also healthcare deserts, where residents don’t have access to regular healthcare.

The impact of needing healthcare is also important to note.

When women do not have access to quality healthcare, there is a financial impact for the economy.

In Philadelphia, nearly 3 of 5 (59%) surveyed Black women - the highest rate among the major racial groups represented in the study - said that they experience stress that impacts their physical health.9

Wealth is an individual experience that has no link to the resources of the neighborhood

I know for people in my community, if they haven’t been involved in violence, that a loved one or someone else close to them has been a victim of violence, so that definitely creates stress. Watching the news – that creates stress. Those stressors are impeding our mental and physical health, you know, our well-being as a whole.”

- Tamara Cobb

Tamara Cobb exchanges some fruit for a plant

If I can’t walk out my door, my peace isn’t that it’s just peaceful in here. My peace is that it’s peaceful around here. If I got to worry about going to the store and not getting back in my door, then yeah, that would disrupt my peace.”

- Tracey Wallington

History tells us that policy is at the core of gender wealth inequity in the US and Philadelphia. Intentional policy change can affect wealth distribution by lessening many of the burdens women face disproportionately in their personal and professional lives. While policy change takes time, many local and national organizations have been actively working to reduce or spread awareness of the issues raised in this report. Supporting their work through donations is one way to advance the journey to gender wealth equity in addition to advocating for policy change.

WOMEN’S WAY is the Greater Philadelphia region’s leading nonprofit organization dedicated to the advancement of women, girls, and gender and racial equity.

***When we refer to women, we mean cis and trans women and femme-identified people (which includes anyone who is not a cis or trans woman but who identifies as feminine), and also those who identify as gender-expansive, nonbinary, and/or gender-nonconforming.